On-chain data shows XRP is observing a spike in its adoption and network activity. Here’s what this could mean for the asset.

XRP New Addresses & Active Addresses Have Both Spiked

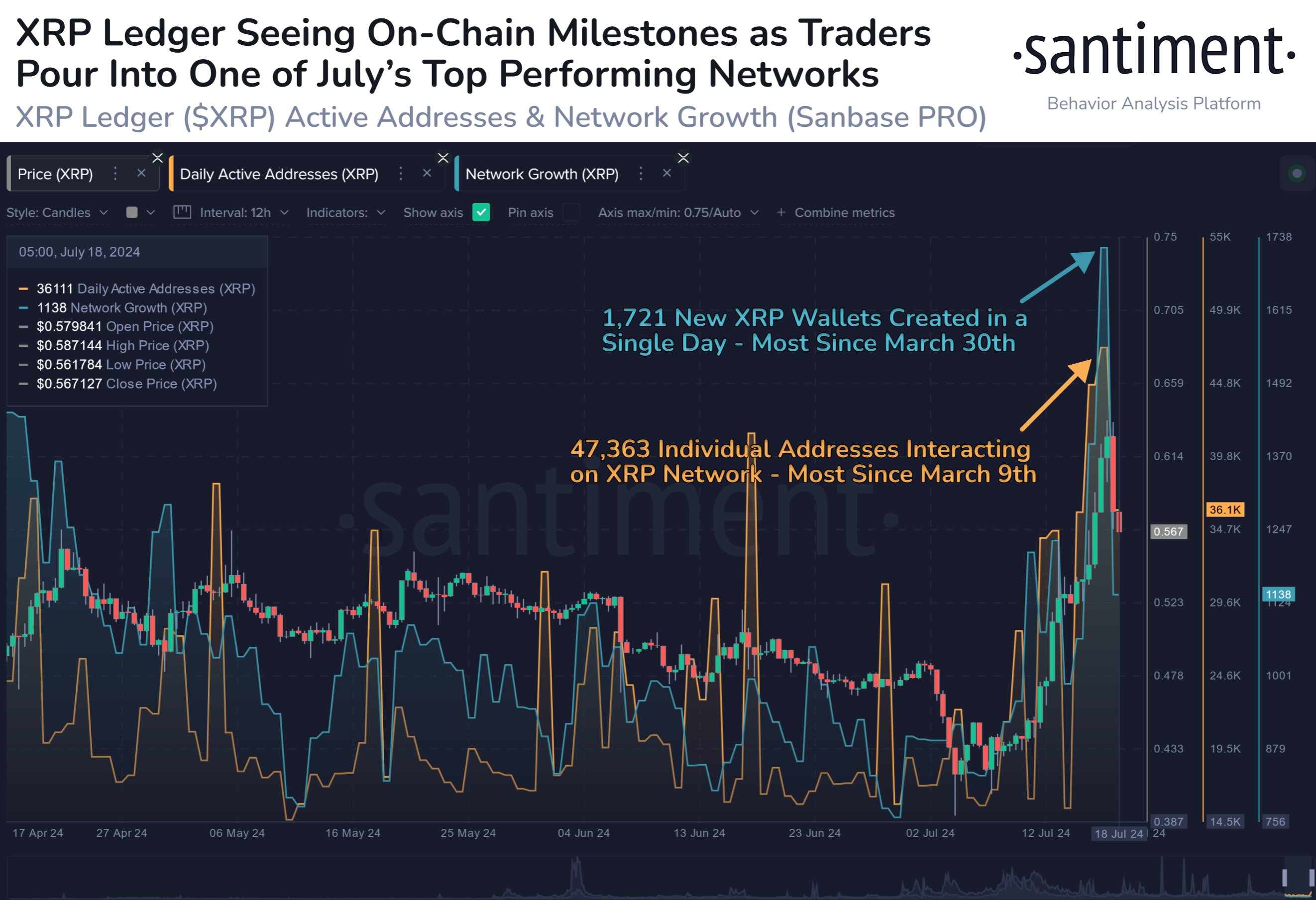

According to data from the on-chain analytics firm Santiment, XRP has seen two metrics hit the highest levels since March recently. The first indicator of interest here is the “Network Growth,” which keeps track of the total number of new addresses being created on the network daily.

Spikes in the Network Growth can appear for a couple of reasons. The most obvious of the two is fresh adoption, as new investors coming in would naturally create new addresses. The other factor can be existing users creating multiple wallets for a purpose like privacy.

Generally, both are at play whenever the indicator rises, so it can be assumed that some net cryptocurrency adoption is occurring.

The second relevant indicator is the “Daily Active Addresses,” which measures the total number of unique addresses participating in some transaction activity on the network daily.

The active addresses can be considered the same as the unique number of active users on the chain, so this indicator’s value can tell us about the daily traffic the coin is currently witnessing.

Now, here is a chart that shows the trend in both of these metrics for XRP over the last couple of months:

As the above graph shows, sharp spikes in XRP in the network growth and daily active addresses have recently been observed. This would suggest that the network is observing both an influx of users and activity from existing ones.

More specifically, the blockchain saw 1,721 new addresses coming online and 47,363 users interacting at the peak of this spike. This growth for the cryptocurrency has come as its price has surged by more than 18% over the past week.

Investors find sharp price actions like rallies exciting, so new users get attracted to the network, and existing ones come alive to make some moves during these periods. As such, these latest spikes in the Network Growth and Daily Active Addresses aren’t unusual.

Spikes like these are essential for any rally to be sustainable, as the increased traffic provides the fuel such a move needs to keep going. Any rallies in the past that have failed to attract attention have ended up dying off before long. Thus, this development may be positive for XRP’s latest recovery run, at least on paper.

XRP Price

While the on-chain metrics are looking optimistic, the XRP price has still encountered an obstacle, as it has dropped back to $0.55 after breaking above $0.63 just a couple of days back.