A new video by macro guru Raoul Pal is currently causing quite a stir in the XRP community. In the recently published video update, Pal, the co-founder and CEO of Real Vision, says that investors should avoid older coins like XRP and ADA. His analysis presents a sobering outlook for these longstanding members of the crypto ecosystem, arguing that they may no longer be at the forefront of blockchain innovation.

Sell XRP Now?

During his discourse, Pal critiqued the capacity for innovation and adaptation in projects like XRP and ADA, which have been market fixtures but, in his view, now lack the dynamism seen in newer blockchain ventures. He posited that these older coins are being overshadowed by newer, more agile entrants that promise greater technological advancements and potential returns.

“XRP, we’ve gone through this before […] you might be right, you might love it, forever just please move to whatever the strong momentum is,” Pal urged. This statement encapsulates his broader message: that nostalgia or loyalty to a particular crypto asset could hinder investors from capitalizing on emerging opportunities.

A central theme of Pal’s commentary was the cult-like communities that have formed around certain cryptocurrencies. He argues that these communities often foster an emotional attachment that can cloud judgment and investment decisions.

“I know there’s that fear in your head that this time it’ll be the big one, you’ll get plenty of notification, you get back in but don’t miss the bull market because you’re in a narrative of the past. I beg you don’t do this and the communities are huge and I feel like and I don’t want to get attacked by people online for this but I just feel like you’re being done a disservice by being a cult,” Pal stated.

By using the term “mercenaries,” Pal emphasized the importance of being profit-driven rather than emotionally driven in investment decisions. He suggested that investors should be ready to deploy their capital wherever the best risk-adjusted returns can be found, rather than sticking with investments out of loyalty or hope.

“I feel like you’re being done a disservice by being a cult. Our job is to be mercenaries. We’re in the job to make money not to be a cult. Cults don’t make money except for the leaders. Be a mercenary, lend out your capital to the opportunities that will offer you the best risk adjusted return,” he explained.

Pal elaborated on the pitfalls of hopeful investment strategies devoid of pragmatic considerations. “Cardano, XRP, there’s a whole bunch of these. I really hope you’re right but hope is not an investment strategy. Okay, so I’m not trying to insult you. I’m not trying to be rude. Please just understand my heart is coming from a good place. I’m trying to help you all.”

XRP Community Reactions

The reactions to Pal’s comments were mixed, with significant pushback coming from prominent members within the XRP community. Fred Rispoli, a pro-XRP lawyer, responded with measured disagreement: “I thoroughly enjoy Raoul Pal and, until shown otherwise, consider him authentic and well-meaning. I respectfully disagree with him on XRP but that thesis is reasonable and has not been proven wrong…yet. I do agree there exist ‘old’ coins (cough, EOS) whose days are long past.”

Bill Morgan, another pro-XRP lawyer, critiqued Pal’s arguments for lacking depth and specificity: “His comments may have more value if he gave even one cogent reason why people should not hold XRP other than indirectly referring to its age. If that is his only criteria then he might as well add Bitcoin and Ethereum to Cardano and XRP as they also are old.”

Yassin Mobarak of Dizer Capital highlighted the high-risk, high-reward nature of XRP: “XRP is the kind of crypto you don’t want to be caught not being in it when it skyrockets. Until then it’s painful, boring and utterly demoralizing to hold.”

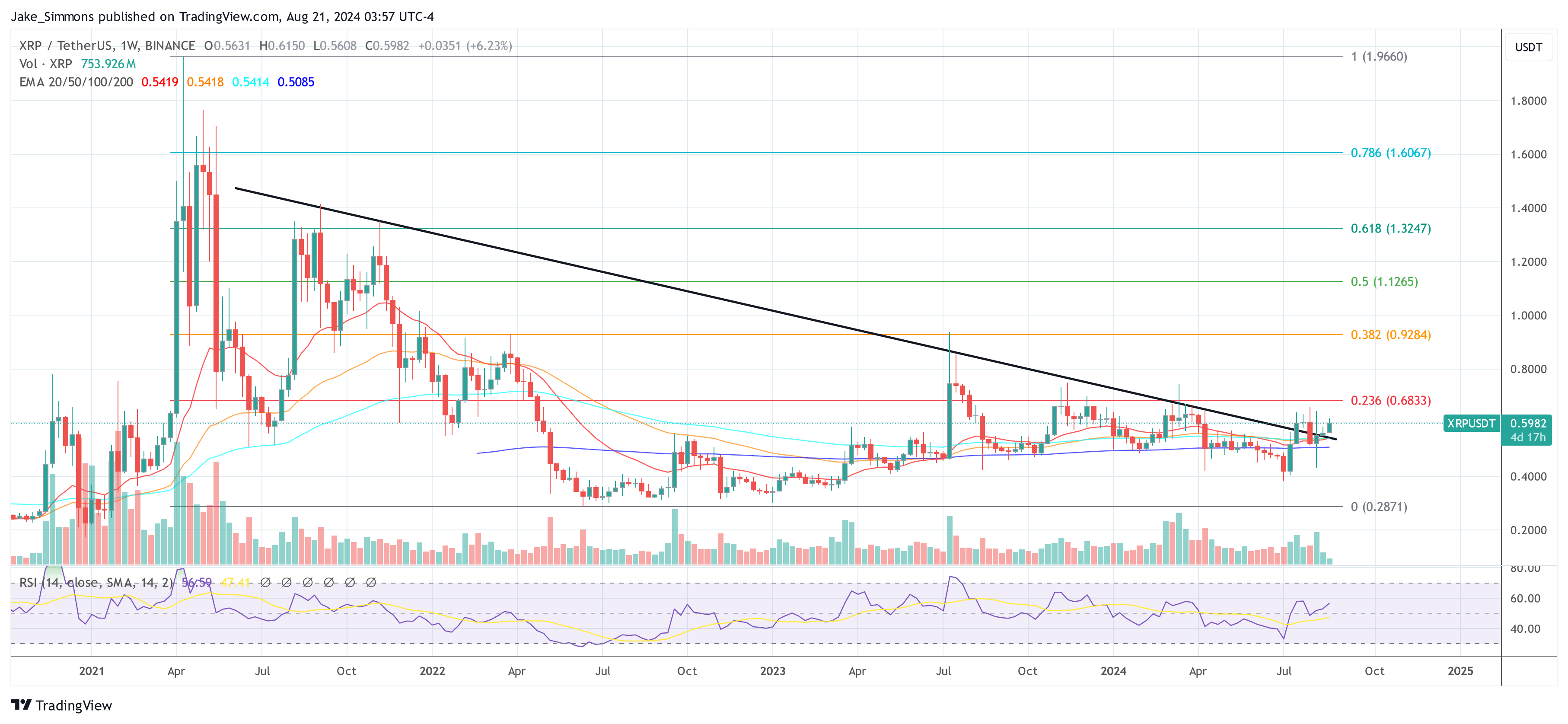

At press time, XRP traded at $0.5982.