The XRP market experienced a downbeat end to January translating into a 7.05% loss over the past seven days. In regards to future price movements, popular analyst Egrag Crypto states the altcoin is currently at a key crossroads with an equal chance to move in either a positive or negative direction.

XRP Set For Price Breakout, But How High Can It Go?

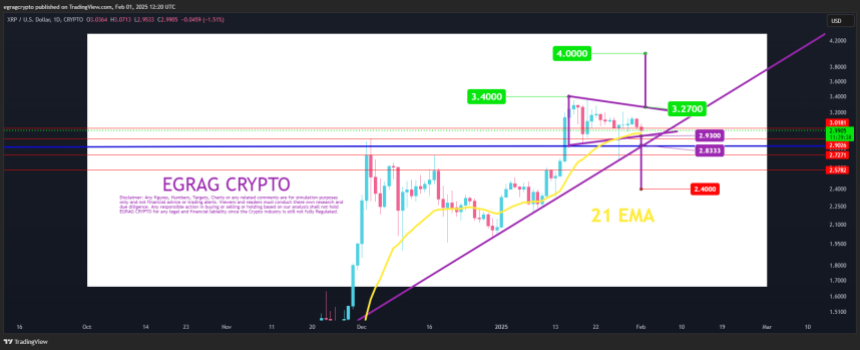

In an X post on February 1, Egrag Crypto explains that XRP’s recent slump has resulted in the asset retesting two crucial levels namely the 21 EMA and and the lowest boundary of a symmetric triangle.

The exponential moving average (EMA) is a technical indicator that smoothens out price data over a period of days (i.e. 21 in this case) while giving more weight to recent prices. It is commonly used in trend confirmation with a price dip below the EMA line indicating a bearish trend and vice versa for a bullish trend. On the other hand, a symmetric triangle formed by price movement signals a period of consolidation before a decisive price breakout.

With the price of XRP simultaneously hovering near the 21 EMA line and the lower boundary of the symmetric triangle around $2.93, the altcoin presents a rather delicate situation to traders and investors alike. According to Egrag Crypto, further declines for XRP are possible. However, prices are unlikely to fall below $2.83 ( the ascending purple line) which has served as a strong support zone based on historical data.

However, based on the sole analysis of the symmetrical triangle, a break below the lower boundary could force XRP to trade as low as $2.40. Alternatively, should XRP break above the upper boundary of the triangle, it could immediately rally to $4. Egrag Crypto warns that both breakout possibilities are equally weighted. Therefore, the XRP market is subject to high levels of volatility over the coming days.

Whales Offload 70 Million XRP In 4 Days

In other news, crypto expert Ali Martinez reports that XRP whales are currently on a selling spree having offloaded 70 million XRP, valued at $204.4 million, over the past day. High selling activity especially from whales is a bearish signal that signals uncertainty about the future profitability of an asset. Alternatively, certain long-term holders may be looking to take profit.

However, XRP retail investors may expect more price drops in the short term, barring the introduction of significant buying pressure. At press time, XRP trades at $2.93 reflecting a 3.10% decline in the past day. Meanwhile, the asset trading volume is down by 12.60% and valued at $4.06 billion.