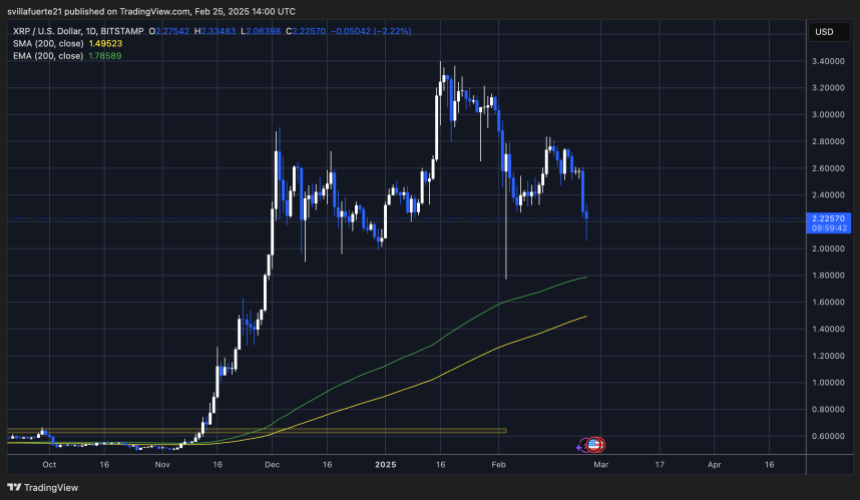

XRP price is holding above key support levels after an aggressive 20% drop since last Sunday. Bulls have lost control, but despite the selling pressure, XRP remains strong above the $2 mark—a critical level that must hold to prevent further declines. The recent downturn has added to market uncertainty as investors look for signs of stabilization.

Top analyst Ali Martinez shared an analysis on X, revealing that XRP is breaking out of an ascending parallel channel, signaling a potential downside. According to Martinez, XRP could target $1.65 if the breakdown continues, making the next few weeks crucial for its price action.

The overall market remains under pressure, with altcoins struggling to reclaim key levels. Bulls could push for a recovery if XRP manages to hold above $2 and regain momentum. However, failing to defend this support could result in a deeper correction, putting additional pressure on the broader crypto market.

XRP Bulls Try To Reclaim Bullish Momentum

XRP is trading below key levels as it tries to reclaim bullish price action amid the broader market selloff. The entire crypto market has been under pressure after Bitcoin lost its weekly support, triggering panic and increasing selling pressure across altcoins. XRP, like most major assets, has struggled to hold its ground, dropping sharply over the past few days.

Martinez’s analysis on X reveals that XRP is breaking out of an ascending parallel channel, signaling a potential move lower. According to Martinez, XRP could target $1.65 if it fails to hold current demand levels. This breakdown aligns with the overall market weakness, where bulls are struggling to regain control.

Despite the bearish outlook, XRP is still holding above the $2.20 mark, where buyers are attempting to defend the price from further declines. Short-term selling pressure seems to be fading, and if bulls can maintain support above this level, a recovery could be on the table. However, if XRP fails to reclaim the $2.40 level soon, bears could take control and push the price further down.

The next few days will be critical for XRP’s price action as the market looks for a potential reversal or continued downside.

Price Holds Above Key Support

XRP is trading at $2.22 after briefly dropping to $2.05, following the recent wave of selling pressure that has shaken the entire crypto market. The price has struggled to reclaim higher levels as fear and uncertainty continue to dominate sentiment. Investors are closely watching for a potential recovery, but bears remain in control for now.

For XRP to regain momentum, bulls must hold the price above the $2.20 level and establish it as strong support. A sustained hold at this level could set the stage for a recovery rally, with the next key resistance around $2.40. However, if selling pressure intensifies and XRP fails to maintain its current support, the $2 mark will be the last stronghold for buyers.

If XRP breaks below $2, further downside could follow, potentially dragging the price toward lower demand zones. On the other hand, a quick bounce above $2.30 could indicate a shift in momentum, allowing bulls to regain control and push the price toward $2.50 and beyond. The next few days will be critical for XRP’s short-term price action, as investors look for signs of strength amid ongoing market volatility.

Featured image from Dall-E, chart from TradingView