On-chain data shows the XRP network has seen a burst of activity and address creation recently, something that could turn out to be a bullish signal.

XRP Active Addresses & Network Growth Have Both Spiked Recently

According to data from the on-chain analytics firm Santiment, address-related indicators have spiked for XRP recently. The first metric of relevance here is the “Daily Active Addresses,” which keeps track of the total number of addresses that are participating in some kind of transfer activity on the network every day.

The unique number of active addresses can be considered the same as the number of users making use of the network, so this indicator’s value essentially tells us about the amount of traffic that the chain is receiving.

The other indicator of interest is the Network Growth, which measures the total number of new addresses that are being created on the network every day. An address is said to be ‘created’ when it makes its first transaction on the blockchain.

While the Daily Active Addresses tells us about the utility on the network, the Network Growth provides the information about how adoption of the cryptocurrency is coming along.

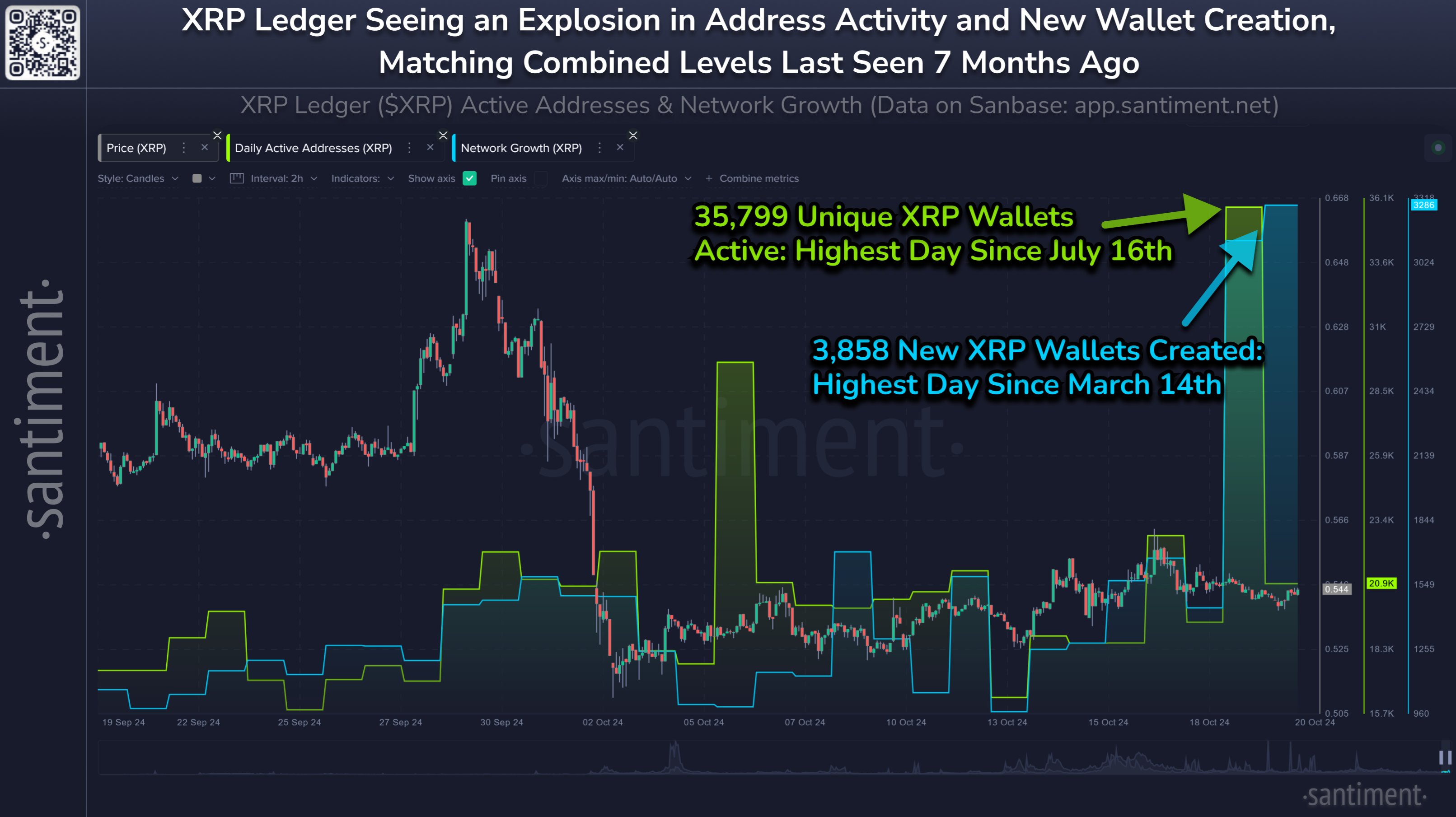

Here is a chart that shows the trend in the Daily Active Addresses and Network Growth for XRP over the past month:

As is visible in the above graph, the XRP Active Addresses and Network Growth have both registered a sharp increase during the last couple of days, implying the utility and adoption of the network have shot up.

In this latest activity boom, the blockchain has seen transactions from 35,799 unique users, which is the highest value since July. Similarly, 3,858 new users have joined the network, a peak not witnessed since March.

Now, as for what these trends could mean for the asset, the answer differs between the two indicators. Adoption is usually a bullish sign in the long-term, as a wider user base provides a more sustainable foundation for future price moves to grow on. Utility, on the other hand, is usually something that can carry short-term effects, as all the elevated trading activity from the users can induce volatility in the coin’s price.

This volatility can take the asset in either direction, depending on what sort of activity it is exactly that the users are participating in. The Daily Active Addresses by itself contains no information about this split, so it can be hard to speculate on the matter using this indicator alone.

Considering that the spike in activity has come while the coin has been consolidating, though, it’s possible that the users are making a buying push. If so, then XRP could see the start of a fresh surge from this.

XRP Price

XRP hasn’t been able to make much recovery from its crash to start the month as its price is still trading around $0.544.