XRP has crashed alongside the rest of the cryptocurrency market, but this analyst thinks the asset could be the one to find a quick recovery.

XRP Has Been The Top Traded Altcoin On Binance This Month

In a new CryptoQuant Quicktake post, community analyst Maartunn has talked about how the altcoins currently compare against each other based on their monthly Binance futures trading volumes.

The “trading volume” here refers to an indicator that keeps track of the total amount of a given asset that’s becoming involved in trading on a centralized exchange. In the context of the current topic, the platform is Binance.

Below is the chart shared by the analyst that shows the trend in the monthly value of this metric for various top altcoins in the sector.

From the graph, it’s apparent that during most months of this year, Solana (SOL) dominated the trading volume on the exchange. A shift has occurred in the market during the past couple of months, however, as SOL has lost its number one spot.

Last month, it was Dogecoin (DOGE) that managed to surpass the asset to become the number one altcoin in this metric, while this month, XRP has overtaken both of them.

So far, XRP has seen trading volume amounting to $116.6 billion on the exchange. This value is also certain to go even higher, as this month of December still has one-third of the way to go.

While Binance doesn’t make up for the entire sector, the exchange is still the largest in terms of volume, so the trend on there can be representative of the wider market. “It’s important to track the top-traded coins on Binance, as they should be your main focus when trading altcoins,” notes Maartunn.

During the last couple of days, the entire cryptocurrency sector has witnessed a crash. Based on the monthly Binance volume, though, the analyst says, “XRP seems to be one that could recover quickly.”

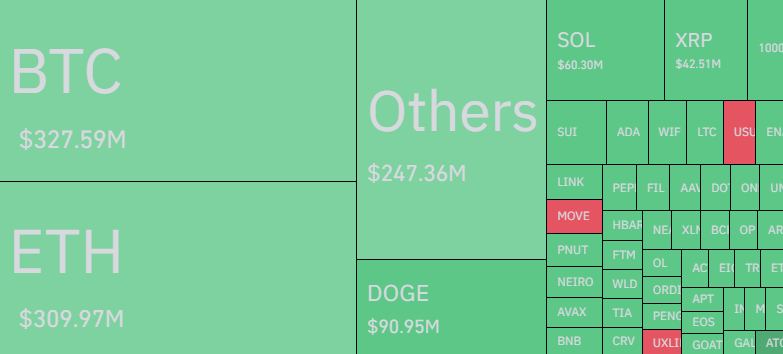

In some other news, the market plummet in the last 24 hours has meant that the derivatives side of the cryptocurrency sector has registered a massive amount of liquidations, according to data from CoinGlass.

Out of the $1.40 billion liquidations that have occurred inside this window, XRP-related contracts seem to have contributed for around $42 million, as the below heatmap shows.

Interestingly, Dogecoin and Solana appear to have seen a larger flush than XRP. This may be down to the fact that both of these assets have also witnessed a deeper price drawdown.

XRP Price

During the latest crash, XRP briefly slipped under the $2.0 level, but it seems the coin has managed to recover back above the mark for now as its price is trading around $2.1.