According to CoinShares’ latest weekly report, crypto investment products registered slight net inflows last week, with a total of $6 million entering the market.

The figures reflect ongoing uncertainty among investors, with notable variations in sentiment both across regions and among individual crypto assets. Despite a relatively stable start to the week, broader macroeconomic data, particularly from the US, had a visible impact on fund flows.

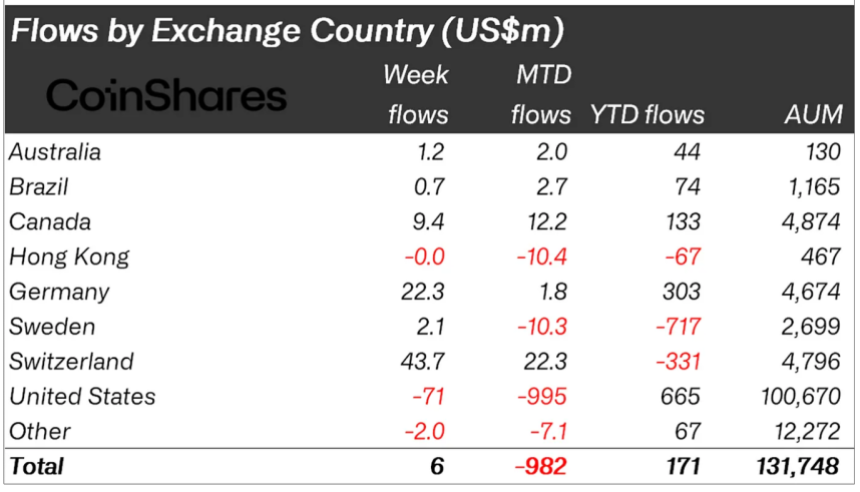

US Crypto Outflows Lead the Week, While European Sentiment Remains Positive

CoinShares’ Head of Research, James Butterfill, noted that the release of “stronger-than-expected “US retail sales data mid-week coincided with a significant capital outflow. As a result, although there were early inflows, mid-week saw a pullback of $146 million, erasing much of the earlier gains.

Regional trends were particularly mixed. The United States led the weekly outflows, with investment products domiciled in the country seeing a net withdrawal of $71 million.

By contrast, European markets maintained a more positive outlook. Switzerland saw inflows of $43.7 million, Germany followed with $22.3 million, and Canada added $9.4 million, highlighting regional divergence in crypto investment behavior.

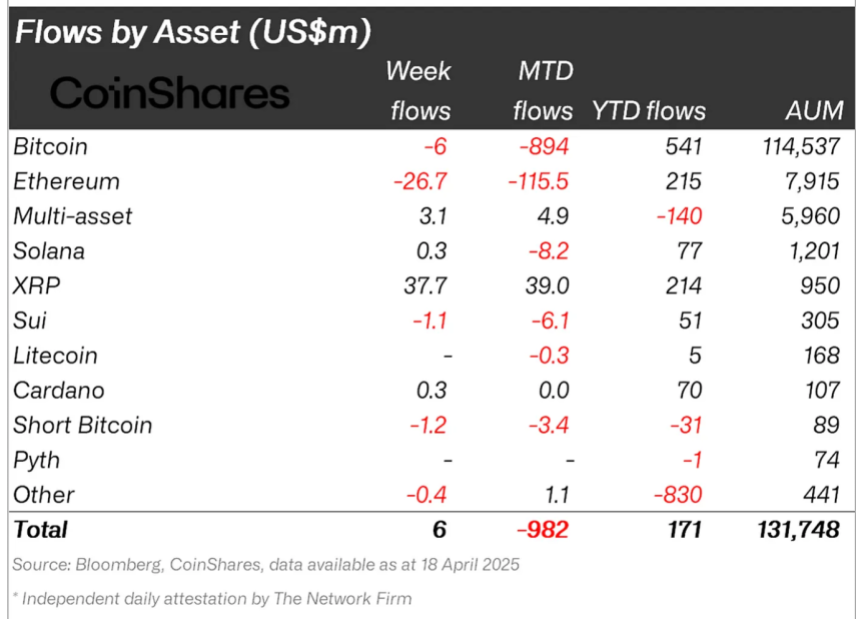

Bitcoin remained the focal point of fund movement throughout the week. Intra-week flows signaled conflicting views among investors, ultimately concluding with minor outflows totaling $6 million. Short Bitcoin products also saw continued reductions, with $1.2 million in outflows last week.

This marks the seventh consecutive week of outflows for short positions, bringing the cumulative withdrawal from these products to $36 million. According to CoinShares, this now accounts for approximately 40% of total assets under management (AUM) in short Bitcoin investment vehicles.

Ethereum Sees Continued Pressure, While XRP Maintains Upward Trend

Ethereum faced ongoing outflows, continuing an eight-week trend. The asset experienced a further $26.7 million in withdrawals last week, bringing total crypto outflows since the start of the recent streak to $772 million.

Despite this consistent pressure, Ethereum still holds the second-highest position in year-to-date (YTD) fund flows, recording $215 million in net inflows so far in 2024. This indicates that while recent sentiment has cooled, longer-term interest remains comparatively strong.

In contrast, XRP recorded notable weekly inflows of $37.7 million. This recent performance has elevated the token to third place in YTD fund flows, just behind Ethereum, with a total of $214 million in net inflows since the beginning of the year.

Thecrypto’s resilience in the face of broader market uncertainty has been reflected in recent fund behavior and continues to draw attention from investors allocating capital to diversified crypto asset portfolios.

Featured image created with DALL-E, Chart from TradingView