XRP has seen fresh bullish momentum recently as on-chain data shows the whales have been participating in some rapid accumulation.

XRP Has Registered A Rise Of Over 17% In Past Week

The cryptocurrency market as a whole has observed a bit of a recovery wave in the past day, but among the top coins, one asset in particular has stood out: XRP.

The asset has witnessed an increase of around 7% during the last 24 hours, which has taken its price to $2.75. Below is a chart that shows what the coin’s recent performance has been like.

At the peak of this rally, XRP even briefly surpassed the $2.89 mark, but it has since seen a drop to the current level. Nonetheless, the asset is still up more than 17% in the past week, which makes it the best performer among the top 30 cryptocurrencies by market cap.

Now, what’s the reason behind this overperformance from the coin? Perhaps on-chain data could provide a hint or two.

Whales Have Been Busy Buying The Asset Recently

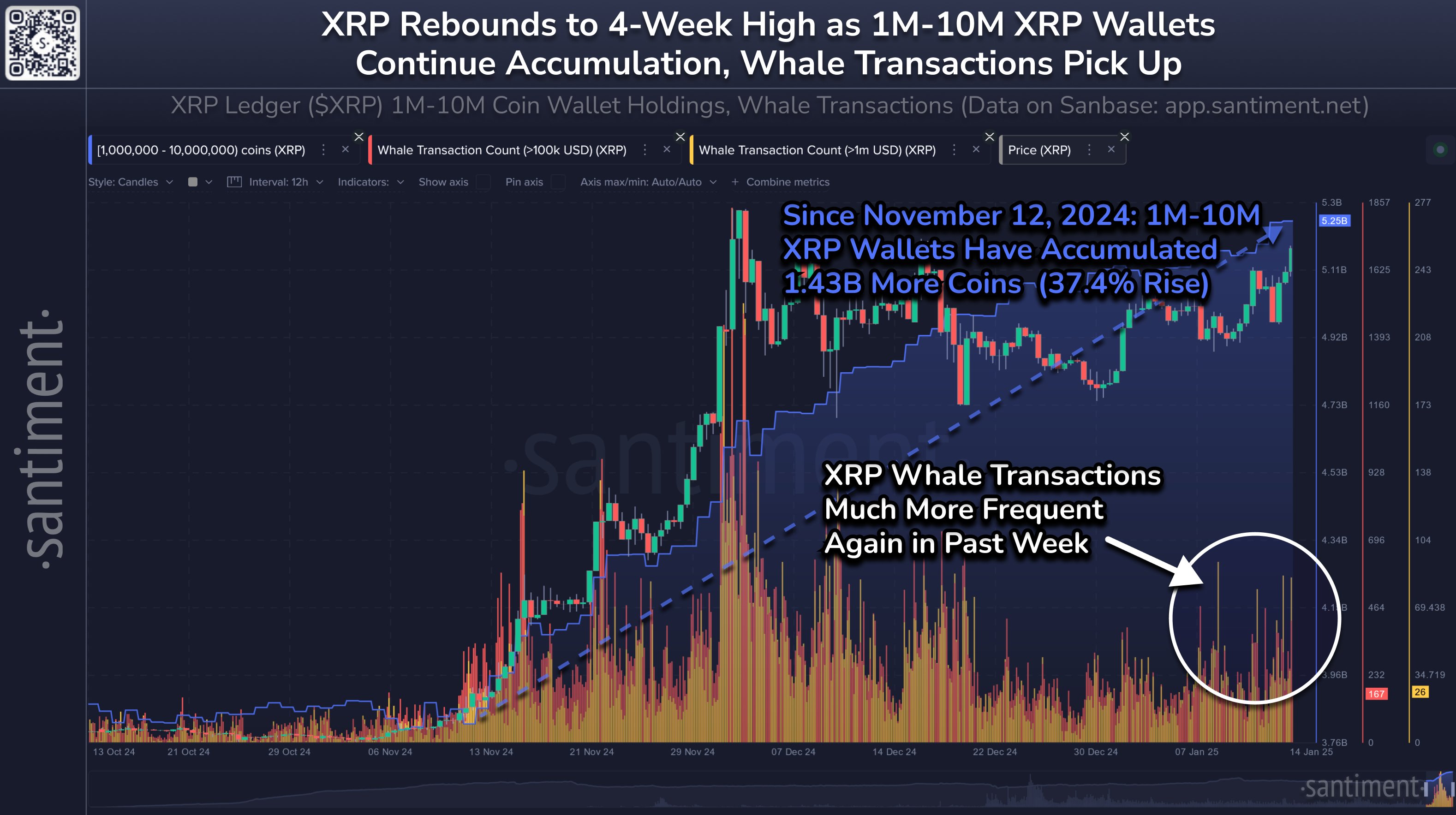

In a new post on X, the on-chain analytics firm Santiment has pointed out how the latest rally in XRP has been supported by continued ‘enormous’ accumulation from the whales.

Whales refer to the entities on the network that own between one million and ten million tokens of the cryptocurrency. At the current exchange rate, the former converts to about $2.75 million, while the latter to $27.5 million.

Thus, the only investors who would qualify for this group would be the massive ones. Such holders tend to carry some degree of influence in the market, so their behavior is often worth keeping an eye on. One way to track their moves is through the “Supply Distribution” indicator, which measures the combined amount of the assets that the cohort is carrying in its wallets.

Here is the chart for the indicator shared by Santiment that shows the trend in the holdings of the XRP whales:

As displayed in the above graph, the XRP Supply Distribution for the whale group has been following an upward trajectory for a while now. In total, these humongous investors have added 1.43 billion coins to their wallets during this accumulation spree over the last two months.

This reflects a rise of a whopping 37.4% for their holdings in this window. The fact that the whales have continuously been buying despite the fact that the coin peaked in December is naturally a positive sign, as it implies the most influential of beings still find the asset worth buying.

The accumulation has only furthered during the past week, which may be why the XRP price has seen a recovery rally.