XRP once more takes the center stage in crypto as momentum for the altcoin’s price builds up. Over the weekend, XRP jumped 8% to a high of $0.63 before it settled slightly lower at $0.6131.

Although it witnessed this minor pullback, analysts are sharing their predictions on the token. Specifically, two popular personas in the crypto analysis world, Bobby A. and GoldE33, predict that XRP is ready for a key breakout.

Bobby A. thinks that XRP is poised for an “explosive charge”, while GoldE33 highlights a key technical indicator that could support this bullish outlook.

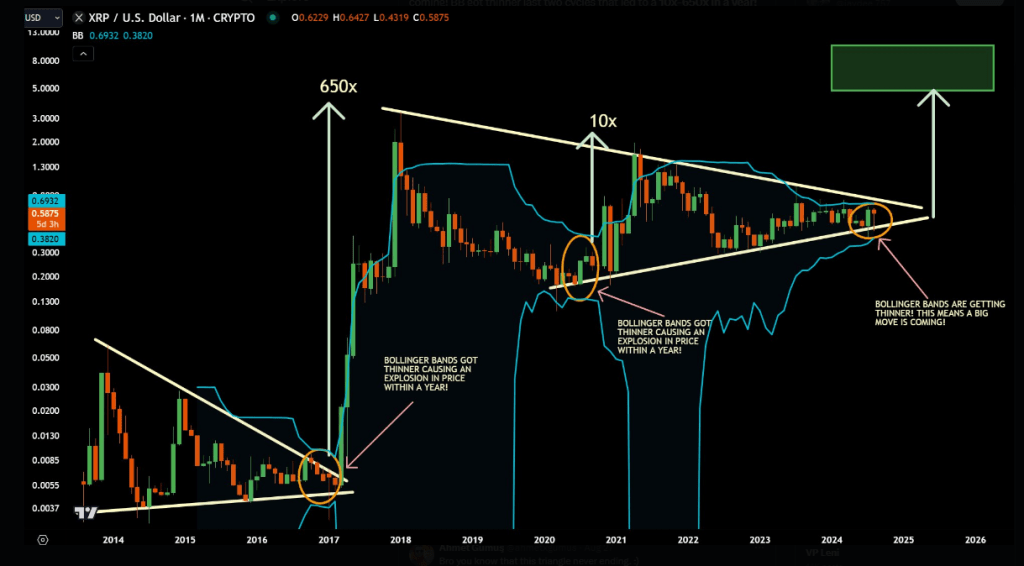

The analysts shared their thoughts on X, formerly known as Twitter, thinking the same – that it may push the altcoin up past its current resistance levels. Bobby A.’s charts reveal a very promising breakout pattern on the monthly timeframe, while GoldE33 identifies the shrinking Bollinger Bands as a sign of an imminent price explosion.

An explosive charge ready to go high order. #XRP

pic.twitter.com/93zeWYKgSh

— Bobby A (@Bobby_1111888) August 24, 2024

Resistance And Possible Breakout

Bobby A. is quite straightforward with his predictions. He’s set the first target at $0.87 — a 45% increase from its current price of $0.60 for XRP. Were XRP to reach that level, it would be considered major as it heaves the token well above its long-term descending trendline.

This could mean the change in market sentiment from bearish to bullish, providing an uptick in investors that might drive the price even higher.

And the road back to higher prices is filled with obstacles. Thus, Bobby A. has identified a number of resistance levels, which the XRP price would have to break through as it edges closer to its previous all-time high of over $3.

A breakout above this level would be monumental indeed, possibly opening the floodgates for XRP in uncharted territory. But the analyst remains hopeful; he says when XRP clears the $3 mark, a smooth sail toward $5.31 could be highly expected.

The Role Of Bollinger Bands

While Bobby A. used resistance and potential price targets in his analysis, GoldE33, on the other hand, makes use of Bollinger Bands, a tool used for the measurement of volatility and price action.

#XRP – Bollinger Bands – When BB get thinner, it means a BIG move is coming! BB got thinner last two cycles that led to a 10x-650x in a year!

I called bottom, I’ll call TOP next! Posting HUGE 5 chart update on Patreon/Discord next week w/targets!

400 Retweets for update on X!… pic.twitter.com/IlkI0BmwqK

— JD

(@jaydee_757) August 26, 2024

According to GoldE33, contraction on the XRP chart in the Bollinger Bands is usually a sure sign of an approaching increase in price.

To give a bit more credibility to his statement, GoldE33 refers to two other events in the history of the XRP chart when the Bollinger Bands contracted. Both times, strong upward movements happened.

In one instance, XRP’s price jumped 10-fold, while the other saw the price jump an incredible 650 times. And that historical context gives credence to the argument that XRP might be very close to making a big move.

Profit-Taking Zones And Long-Term Prospects

First, Bobby A. has pointed out that $5.31 is his main profit-taking zone for the short-term gain taker. If XRP managed to get to this level, investors who have bought at the current price would register unprecedented returns.

For longer-term positions, the potential rewards might be higher. His most ambitious forecast looks for XRP to reach as high as $33, which is a colossal 5,387% increase from today’s price. If XRP were to reach this level, most definitely it would join those cryptos that have given awesome returns.

Given the recent price action of the XRP and the technical signs that analysts such as Bobby A. and GoldE33 identified, this token is setting up for a big move. Considering the difficulties lying ahead of it, it would be seen whether it can pierce through these or reach these lofty targets set by these analysts. For now, the market watches closely, with optimism building around the potential of XRP for a historic rally.

Featured image from Pexels, chart from TradingView