XRP tests a crucial supply level after days of choppy price action, showing signs of strength as it prepares for a potential breakout. The price has surged approximately 13% since Friday, putting it within striking distance of the key psychological level at $0.65. Reclaiming this level would signal the start of a new bullish cycle and renewed market optimism.

Analysts and investors closely watch this price movement, hoping XRP will break above $0.65 in the coming days. With the broader crypto market pushing for higher prices, there is a growing sentiment that XRP will follow suit and continue its upward trend.

If momentum continues, surpassing this level could set the stage for a more significant rally, with expectations of new highs.

However, failure to break through could lead to further consolidation or even a retracement. The next few days will be pivotal for XRP as it attempts to solidify its bullish trajectory.

XRP Testing A Crucial Resistance

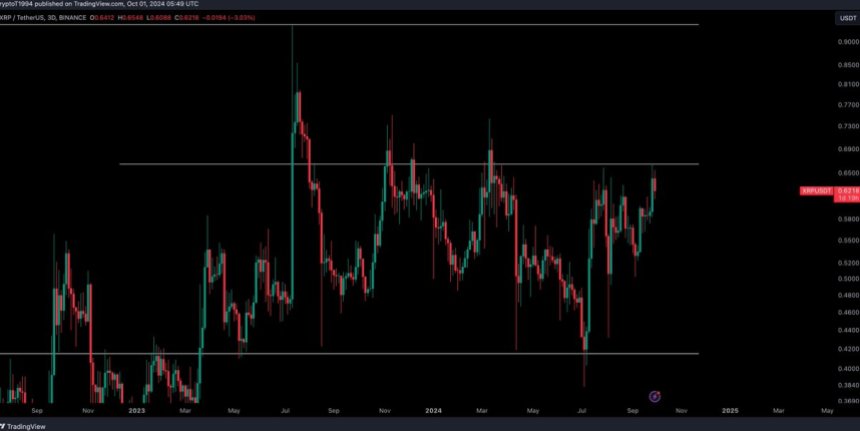

XRP is at a critical turning point as it nears the crucial $0.65 mark, a level it hasn’t consistently closed above since March, aside from a brief breakout. Investors and analysts closely monitor the price action, speculating about potential outcomes as the market remains uncertain. The inability to close above this resistance level has kept XRP in a consolidation phase for months, leaving traders anxious for a clear direction.

Prominent crypto analyst Crypto Tony has weighed in on the situation, sharing a detailed technical analysis on X, highlighting this price level’s significance. According to Tony, reclaiming $0.65 would signal that bulls are back in control, setting the stage for a potential rally.

In his analysis, Tony suggests that if XRP breaks through this resistance, it could push the price to a new target of $0.92—a significant 40% surge from current levels.

The $0.65 level holds substantial psychological and technical importance, and a successful breakout would likely shift market sentiment in favor of a sustained uptrend. However, until this level is decisively reclaimed, uncertainty remains.

All eyes are on XRP to see if bulls can drive the price to new highs in the coming weeks.

Price Action: Key Levels To Watch

XRP is trading at $0.63 after months of volatile price action marked by aggressive pumps and discouraging dumps. The $0.65 level has acted as a daily resistance since early 2023 and was previously a key demand level, offering support from April 2021 to May 2022. However, this level has flipped into a challenging resistance zone for XRP.

If bulls want to regain control and push higher, XRP must break past $0.65 and confirm it as support. A successful breakout would signal strength and potentially set the stage for a larger rally.

However, failure to break through this level would lead to a correction toward the daily 200 moving average (MA) at $0.54, representing a 12% drop. This scenario could also result in further sideways consolidation for XRP, extending the uncertain price action for the coming months.

With the market pushing higher, XRP’s next moves will determine whether it can keep up the bullish momentum or consolidate. For now, the $0.65 mark remains the key level to watch.

Featured image from Dall-E, chart from TradingView