XRP price shows positive signs above the $0.5100 resistance. The price could gain bullish momentum if it clears the $0.520 and $0.5220 resistance levels.

- XRP is eyeing a fresh increase above the $0.520 level.

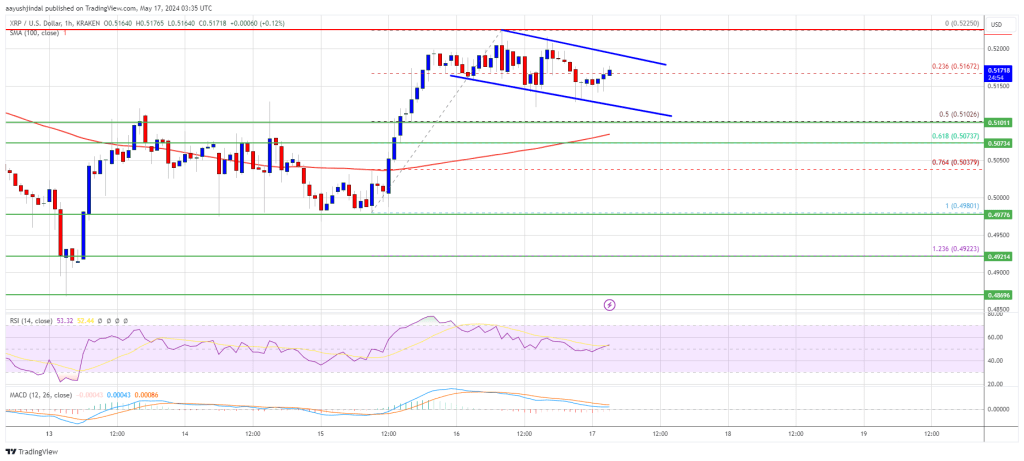

- The price is now trading above $0.510 and the 100-hourly Simple Moving Average.

- There is another short-term declining channel forming with resistance at $0.520 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair could start another increase if there is a close above the $0.520 resistance.

XRP Price Eyes More Upsides

After a steady increase, XRP price faced resistance near the $0.520 zone. Recently, there was a minor downside correction like Bitcoin and Ethereum. The price declined below the $0.5180 level.

There was a move below the 23.6% Fib retracement level of the upward wave from the $0.4980 swing low to the $0.5225 high. However, the bulls are active near the $0.5140 zone. The price is still trading above $0.510 and the 100-hourly Simple Moving Average.

Immediate resistance is near the $0.5195 level. The first key resistance is near $0.520. There is also a short-term declining channel forming with resistance at $0.520 on the hourly chart of the XRP/USD pair.

A close above the $0.520 resistance zone could send the price higher. The next key resistance is near $0.5220. If the bulls push the price above the $0.5220 resistance level, there could be a fresh move toward the $0.5350 resistance. Any more gains might send the price toward the $0.550 resistance.

More Losses?

If XRP fails to clear the $0.520 resistance zone, it could slowly move down. Initial support on the downside is near the $0.5150 level. The next major support is at $0.5120.

The main support is now near $0.510 and the 50% Fib retracement level of the upward wave from the $0.4980 swing low to the $0.5225 high. If there is a downside break and a close below the $0.510 level, the price might accelerate lower. In the stated case, the price could drop and test the $0.4980 support in the near term.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $0.5120 and $0.5100.

Major Resistance Levels – $0.5200 and $0.5220.