A new XRP price prediction has surfaced, with a crypto analyst forecasting that the popular altcoin will experience a dynamic surge to $5.85 in the new week. Based on the Elliott Wave Theory and key technical indicators, the analysis outlines how XRP could see a significant upside after breaking out a symmetrical triangle pattern.

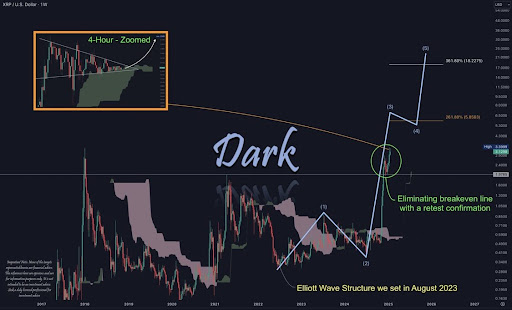

On January 26, Dark Defender, a prominent crypto analyst on X (formerly Twitter), forecasted an XRP price surge to a new all-time high of $5.85. The analyst shared a chart illustrating an Elliott Wave pattern consisting of five waves (1 through 5) in an upward trend

XRP To Break Out To $5.85

Typically, the Elliott Wave theory suggests a cyclical price movement, where Wave 3 is presented as the strongest wave with the most explosive price increases. On the other hand, Wave 4 is highlighted as a corrective phase, while Wave 5 represents the final leg of an uptrend.

Dark Defender revealed that the current XRP Elliott Wave structure was established as early as August 2023, where Wave 3 has consistently targeted the $5.85 all-time high level. This price surge would translate to an impressive 261.8% increase, marking a dynamic shift in the new week.

Once the $5.85 target is achieved, Wave 5, which is the final wave of the Elliott wave cycle, points to a longer-term price target of $18.22. Achieving this level would signify a massive 361.8% increase, marking a historic milestone for XRP.

In his detailed analysis, Dark Defender also pointed out a 4-hour symmetrical triangle pattern on the XRP price chart. This unique technical formation is often a precursor of a significant price movement, which, in XRP’s case, the analyst forecasts a breakout to occur within the next 16 to 20 hours following his analysis.

The breakout from the triangle pattern is expected to align with the broader upward trend. Moreover, the green circle on the chart shows that the XRP price has retested and confirmed support after breaking past the breakeven line toward the $2.4 resistance level. This move sets the stage for the analyst’s projected rally, with a primary target of $5.85 level and a secondary goal of $4.55.

XRP Price Plummets 10% In One Day

While the broader crypto market exhibits bullish sentiments toward XRP due to its impressive performance this year, the popular altcoin is currently facing significant bearish momentum as it struggles to break through key resistance levels.

As of writing, CoinMarketCap’s data shows that XRP has plummeted from a previous price high above $3 to $2.8. The cryptocurrency recorded a 10.3% decline in the past 24 hours after experiencing severe bearish pressure that led to a 14% drop last week.

Despite this bearish performance, analysts remain increasingly bullish on XRP, predicting significant price rallies that would propel the altcoin to new heights. One notable forecast suggests that XRP could rally so high over time and potentially flip Bitcoin, the world’s largest cryptocurrency.