A recent projection indicating a nearly 4,000% increase in XRP value has generated strong discussion among investors and analysts of cryptocurrencies.

An analyst’s projection shows XRP can soar from its present value of $2.41 to a shockingly $99. Although the bitcoin market is not new for audacious forecasts, market watchers have both strong criticism and cautious interest for this specific prognosis.

Market Analysis Shows Historical Pattern Comparison

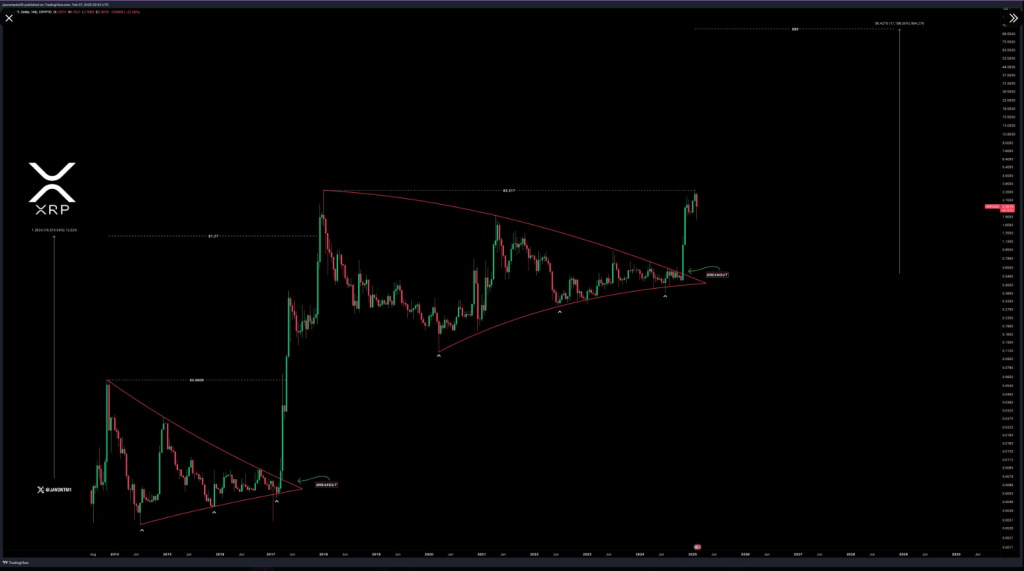

Based on XRP’s performance during the 2017 bull run, crypto expert Javon Marks bases his optimistic forecast on present market conditions. The study notes comparable resistance patterns close to all-time highs, implying a possible breakout like to the one seen six years ago. Critics counter that since then, the terrain of cryptocurrencies has changed dramatically, so such historical analogues could mislead current investors.

$XRP to $99+

:

The truth is, most of what we have to connect dots with on XRP is its past price performance and man oh man is this breakout and run shaping up extremely similar to 2017.

Prices recently met the All Time High, using it as a resistance, just as it did in 2017… https://t.co/gjFsTxYSwG pic.twitter.com/F0wVWE8v0z

— JAVON

MARKS (@JavonTM1) February 7, 2025

Figures Underlining The Bold Forecast

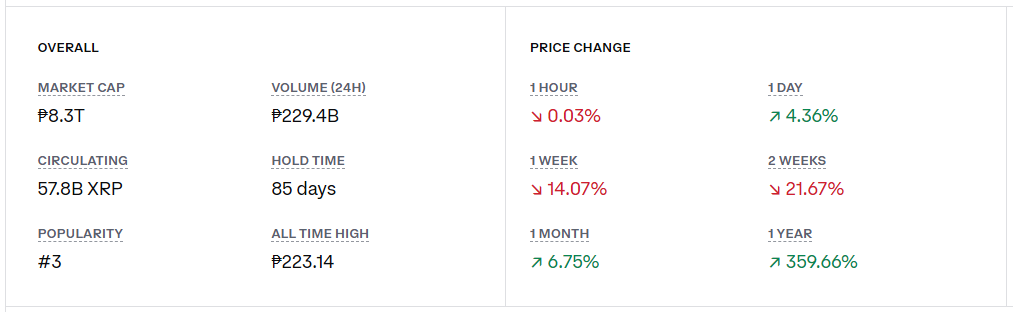

Considering fully diluted valuation, XRP’s market capitalization would reach between $5.7 trillion and $10 trillion at the recommended pricing objective of $99. Given that the whole value of the cryptocurrencies industry is far lower, these numbers have generated concerns among seasoned market observers.

From this standpoint, reaching such a market value would mean XRP by itself would be worth more than multiple major world currencies taken together, a situation many analysts deem economically unlikely.

Beyond Technical Analysis: Practical Application

Although the majority of Marks’ projection is based on technical analysis, proponents highlight a number of real factors that could influence the value of XRP. Ripple’s growing worldwide alliance network and potential inclusion in a US strategic digital asset reserve are two examples.

Another encouraging element is the possibility of the crypto as a SWIFT substitute for foreign transactions. However, these remain speculative scenarios rather than guaranteed developments in XRP’s future.

A Reality Check Regarding Projections Of Prices

Market experts stress the need of treating such extreme price projections with caution. With more institutional involvement, regulatory scrutiny, and market maturity playing major roles, the bitcoin market of 2024 runs under different circumstances than that of 2017.

Although XRP has shown real value and established worthwhile alliances via Ripple’s business activities, the road to $99 presents unavoidable financial and logistical obstacles. The lack of a clear timeline for this extraordinary price increase fuels more uncertainty about this bold projection.

Such a significant price shift would need several important indicators and market conditions to coincide. These include notable increase of Ripple’s payment channels, good legislative advancements, and general institutional acceptance. Even then, the targeted valuation would require unprecedented levels of capital inflow into the XRP market.

Featured image from Gemini Imagen, chart from TradingView