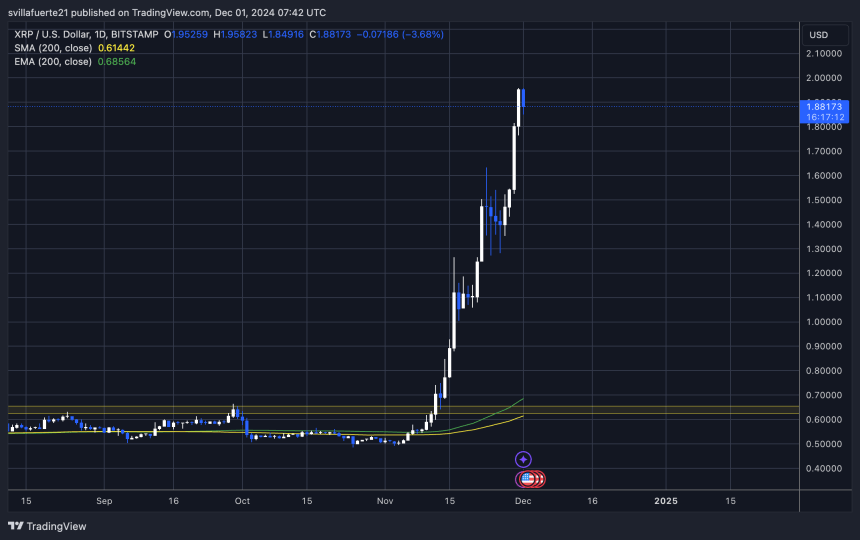

XRP is trading just below the critical $2 mark, a level that served as the local top during the 2021 bull cycle. The price has been steadily climbing, fueled by bullish momentum, and appears poised to push higher. Investors and analysts closely monitor the charts for a definitive signal to confirm a breakout above this crucial resistance.

This psychological price level is a focal point for market participants, with a successful breach potentially marking the beginning of a sustained rally. Top analyst and investor Dark Defender has weighed in on XRP’s outlook, sharing a detailed technical analysis on X. According to his insights, XRP is expected to reach $2.13 in the coming days before experiencing a brief correction. Dark Defender also anticipates further price gains following this pullback as XRP continues to attract bullish sentiment.

A confirmed breakout above $2 could pave the way for new multi-year highs, while a failure to surpass this level may lead to short-term volatility. With its historical significance and current market dynamics, the $2 mark represents both an opportunity and a challenge for XRP. All eyes are now on whether the token can reclaim this milestone and chart a path higher.

XRP Attracts New Demand

XRP has surged over 50% this week, riding a wave of fresh demand that continues to propel its price toward new supply levels. The bullish momentum has sparked significant interest among investors and analysts, with many speculating on the token’s next move.

Top analyst and investor Dark Defender shared a detailed technical analysis on X, highlighting XRP’s evolving market structure on the 4-hour chart. According to his insights, XRP is likely to touch $2.13 soon before facing a potential correction.

Dark Defender’s analysis also identifies key resistance levels on the 4-hour time frame. Notably, resistances at $4.11 and $6.42 align with his secondary price target of $5.85, which follows a support retest at $1.88. These levels suggest a roadmap for XRP’s price action if the current rally sustains its momentum.

As XRP approaches these critical price zones, the coming weeks will be pivotal in determining its trajectory. While the bullish sentiment dominates, the possibility of corrections or consolidations remains. A decisive break above $2.13 could open the door to new highs, but failure to hold key levels might invite short-term volatility.

For now, XRP’s impressive performance and emerging demand position it as one of the most closely watched assets in the crypto market.

Reaching Multi-Year Highs

XRP is currently trading at $1.88 following an impressive run since November 5, marking a staggering 285% increase in less than 30 days. The price recently tagged $1.95, a critical level, and has since entered a consolidation phase as it gathers momentum to push past the pivotal $2 mark. This consolidation suggests that XRP is building the necessary fuel for a potential breakout.

The price action remains decisively bullish, supported by strong market sentiment and increasing demand. Analysts are closely watching the cycle’s top at $1.97, as breaking above this level would likely signal the start of a new leg higher. A confirmed breakout past $1.97 would not only reinforce the bullish structure but could also propel XRP to uncharted highs, aligning with predictions of a parabolic rally.

However, consolidation near these levels indicates that XRP is facing temporary resistance. Market participants are now eyeing key support zones to ensure the current bullish momentum remains intact. If the upward pressure continues, XRP’s next targets could quickly surpass historical levels, solidifying its position as one of the leading assets in the crypto space. For now, XRP remains a focal point for traders and investors as it inches closer to the $2 threshold.

Featured image from Dall-E, chart from TradingView