Recent data analysis reveals a significant decline in the performance of YFI, the native token of the Yearn Finance platform. In a dramatic overnight development, the native token of the Yearn Finance ecosystem witnessed a staggering 40% plunge.

This downturn in YFI’s performance prompts a closer examination of the intricate dynamics within the decentralized financial landscape. The abrupt and substantial drop has ignited a wave of speculation within the community, with some expressing concerns about the possibility of an exit scam.

Much of its recent profits was wiped by the slump. Investors quickly sold off their holdings in YFI in response to the wider selloff that had shook the cryptocurrency market as a whole, which caused a sudden shift in value.

Yearn Finance Suffers An Apparent Exit Scam

As users seek to navigate and capitalize on the potential returns of the crypto market, the fluctuations in YFI’s value underscore the inherent volatility and complexity of DeFi environments.

Specifically, YFI plummeted from $15,450 to $8,950 within a mere 24-hour period. This sharp and rapid descent represents a substantial loss of $6,510 in the value of YFI.

The price of YFI has seen a noteworthy rising trend during the last seven days. The asset was trading at almost $9,000 just a week ago. But it quickly gained momentum and by Friday, it had reached its highest price point in more than a year—above the $15,000 level.

JUST IN: Yearn finance ( $YFI ), one of the biggest platforms in the DeFi ecosystem, has just plummeted over -45% in an apparent exit scam by insiders.

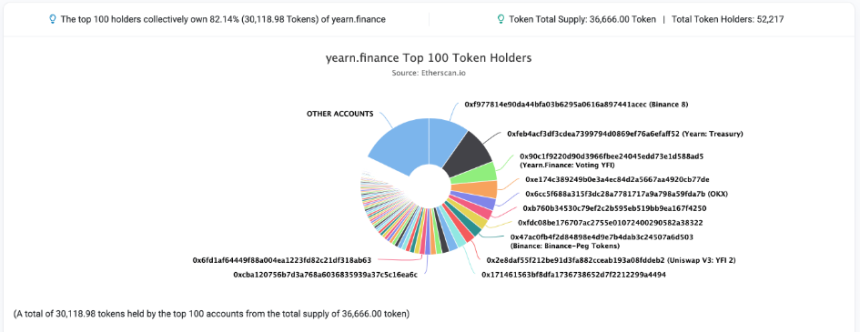

Nearly half of the entire supply for YFI is held by 10 wallets, and over $250 million in market value has vanished in minutes pic.twitter.com/pMqonBcgux

— WhaleWire (@WhaleWire) November 18, 2023

In a matter of hours, the market capitalization experienced a significant decline, with almost $250 million disappearing. The market cap plummeted from $525 million to $275 million. It is once again seeing an upward trend; however, investor sentiment has been negatively impacted by the abrupt decline.

The recent sell-off has incited a weekend characterized by fear, uncertaintly and doubt (FUD) among members of the cryptocurrency community.

According to certain users on X (formerly known as Twitter), there are assertions made regarding the distribution of the token supply, suggesting that 50% of the tokens were held within 10 wallets under the supervision of engineers.

It appears that Yearn Finance $YFI was rugpulled

One of the biggest DeFi platforms plummeted over -50% in an exit scam by insiders

Approx half of the entire supply for YFI is held by ~10 wallets. Over $250 million in market value has vanished in a few hours pic.twitter.com/Y1TbtlkltC

— Solid 堅固 (@SolidTradesz) November 18, 2023

Nevertheless, according to data from Etherscan, it is indicated that a portion of these holders could potentially be wallets associated with cryptocurrency exchanges.

The rollercoaster ride in YFI’s market hasn’t just been a wild descent; it’s been a game-changer for crypto traders riding the waves of this digital asset’s fortune.

Crypto Holders Lose Nearly $5 Million

According to insights from derivative market tracker, CoinGlass, the recent nosedive in YFI has left crypto enthusiasts nursing a whopping $4.99 million in losses through liquidations.

Those traders who wagered on YFI’s upward trajectory found themselves taking the most substantial hit in the aftermath of the digital asset’s dramatic crash. It’s not just numbers on a chart; it’s a tale of high-stakes bets and unforeseen twists in the ever-unpredictable world of crypto trading.

Zooming in on the details, according to CoinGlass data, the brunt of the blow in the near $5 million total liquidations is borne by long positions, tallying up to a substantial $3.5 million in losses.

The majority of these traders find themselves navigating the aftermath on platforms such as the giant Binance, alongside participants from Bybit and OKX.

It’s a vivid snapshot into the crypto battleground, where the casualties of this market turbulence are felt by those who took bullish positions, and the ripples extend across some of the most prominent exchanges in the digital arena.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Tumisu/Pixabay