Quick Take

The Japanese yen’s freefall against the US dollar has reached alarming levels, prompting intervention by Japanese authorities in the foreign exchange market. According to the Wall Street Journal, officials confirmed their actions to support the yen’s value on Monday morning.

The yen’s weakness has been relentless, with the USD/JPY pair surging past the psychologically significant 160 level for the first time since 1990. However, shortly after breaching this milestone, the currency pair abruptly retreated to as low as 154.5, likely due to the reported intervention.

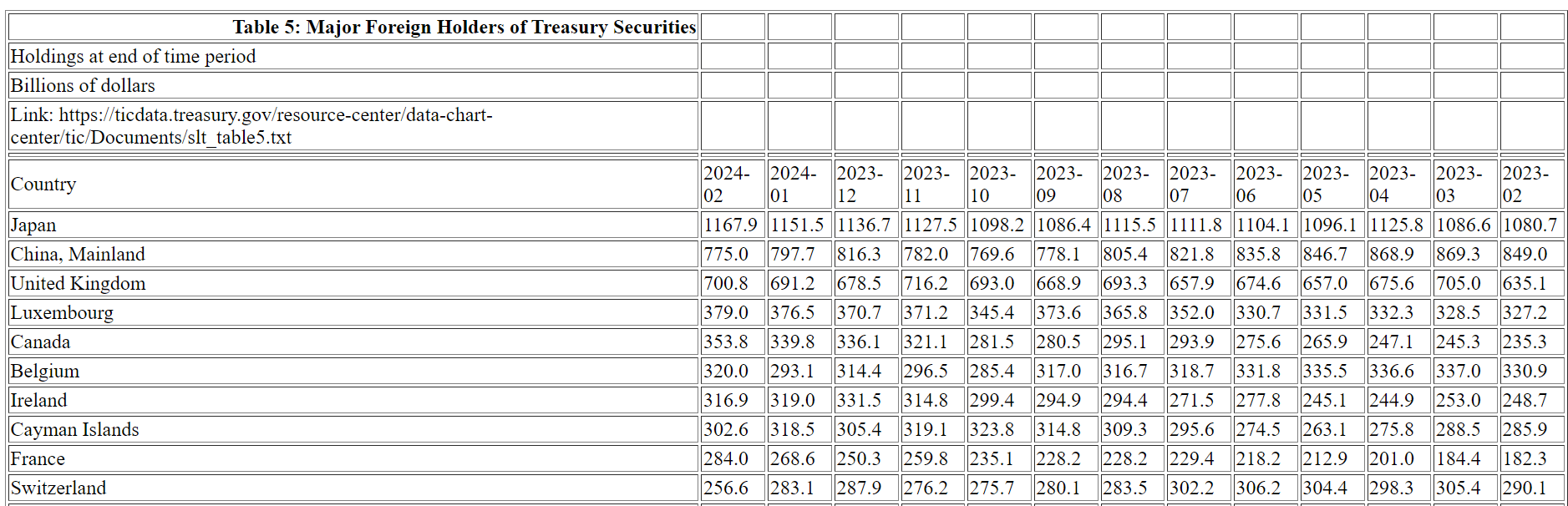

The Bank of Japan (BOJ) faces a dilemma in defending the yen. One option is to utilize its over $1.2 trillion war chest of US Treasuries as of February 2024, according to treasury.gov data. However, such a move could cause US yields to spike, given Japan’s status as a major holder of US debt.

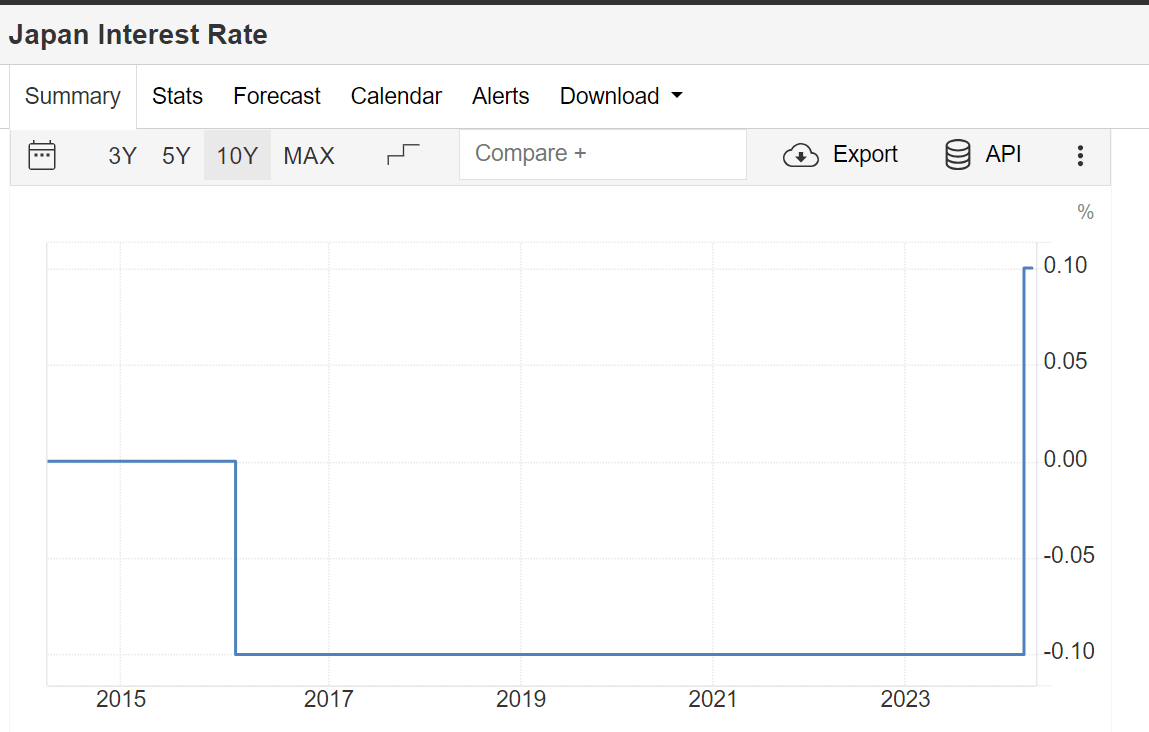

Alternatively, the BOJ could raise interest rates, but it has been reluctant to do so. It has maintained negative rates at -0.1% since 2016 and only recently increased them to 0.1%. However, the BOJ opted not to raise interest rates during its meeting on April 26.

The BOJ’s hesitation to meaningfully raise rates is understandable, as Japan’s debt-to-GDP ratio exceeds a staggering 260%, according to the International Monetary Fund (IMF). Caught between supporting the yen and managing its debt burden, the BOJ finds itself in an unenviable position as the yen’s slide continues unabated.

If the dollar maintains its current momentum, with a year-to-date increase of over 3%, it may exert additional influence on other major currencies like the Euro and Pound. Moreover, if the Federal Reserve remains committed to minimal or no rate cuts in the near future, this will place significant pressure on markets to sustain higher interest rates for an extended period.

The post Yen’s freefall prompts Japanese intervention as USD/JPY hits 34-year high appeared first on CryptoSlate.