Last week’s 210% swing to the upside saw renewed interest in Zilliqa.

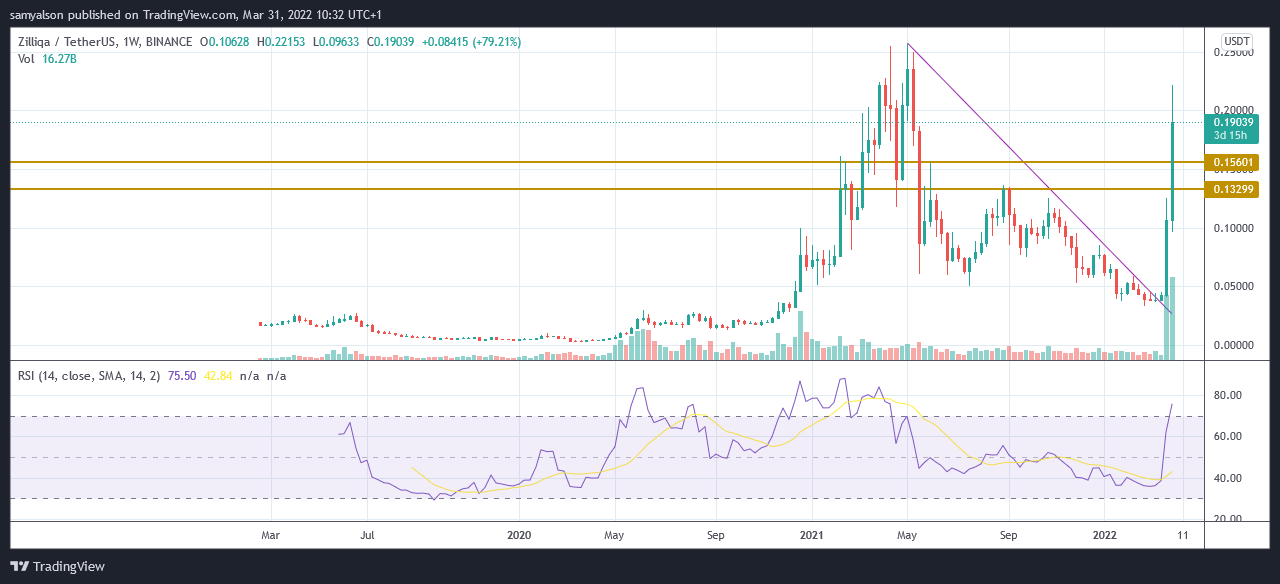

Since peaking at $0.26 last May, a prolonged drawdown followed. It began with a vicious sell-off with $ZIL finding support at the $0.06 level.

Although bulls attempted to fight back, after hitting resistance of around $0.13, the downtrend continued its path in September. A local bottom was found at $0.03 in mid-February. This was proceeded by a tight trading range between $0.03664 and $0.04432.

However, last week’s explosive breakout confirmed a convincing break of the near seven-month downtrend. With that, investor interest in Zilliqa has returned.

But can $ZIL build on this momentum and sustain the reversal?

Zilliqa breakout takes the market by surprise

During the downtrend period, Bitcoin and other Layer 1s saw sizeable gains, particularly from September to November 2021. But with Zilliqa floundering at the time, some took this as evidence the project was dead.

It was only the last month or so that the technicals indicated a change. The week beginning March 14 saw the price peek marginally above the downtrend line. But it wasn’t until the following week’s explosive breakout that wider market sentiment flipped.

In an email to CryptoSlate, Zilliqa’s Head of NFT & Metaverse Sandra Helou said the pump wasn’t surprising to those close to the project. She further commented the price move was “no mistake” considering the team’s focus on growing the ecosystem, even during the lull period.

“The recent pump while it was surprising to the rest of the market to those already invested in Zil and aware of our ecosystem growth and vision it wasn’t a surprise. Zilliqa has always been referenced as a sleeping giant and with our focus and attention across many aligned verticals for growth, it’s no mistake this movement in price is happening.”

$ZIL price analysis

The past few days show $ZIL is acting conversely to the broader crypto market. While the market saw modest gains at the start of this week, $ZIL experienced a slight dip as bulls regrouped following the weekend breakout.

Similarly, Wednesday sees a continuation of bullish form for $ZIL with an +80% swing to the upside on the daily candle, while the rest of the market consolidates with a minor bias to the sell-side on Wednesday.

Large volume occurring with the price spikes suggests a sustained move. However, traders should note that the Relative Strength Index (RSI,) on the weekly time frame, has crept over 70 into overbought territory. Taken in isolation, that doesn’t necessarily signal an imminent drawdown, only that bull fatigue could be a factor in coming price action over the short term.

Esports on the rise

Supporting this reversal are several significant fundamental developments. First off is the exceptional growth of esports in recent times.

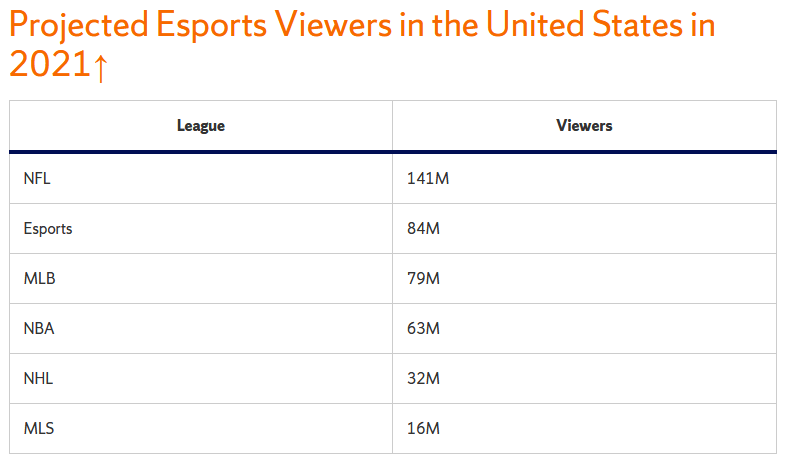

Referring to research conducted by technology consultants Activate, Syracuse University pointed out esports viewership in the U.S will exceed that of every professional sports league, except the NFL, in 2021.

Likewise, a global esports market report conducted by Newzoo two years ago found that 2019 revenue hit $950 million. However, off the back of further integration into popular culture, Newzoo’s latest revenue estimate for 2022 comes in at $1.8 billion, almost double that of 2019.

Head of Marketing at Zilliqa, Art Malkov, said Zilliqa’s strategy in this area is to combine esports with play-2-earn, which has also shown a significant uptick in popularity recently. That way, the firm is positioned to capitalize on growth across both fronts.

“Zilliqa is strongly positioned to lead blockchain and gaming evolution. With projected $200 Billion dollars up for grabs by 2024 in P2E industry, Zilliqa is positioned to capitalize on this growth.”

Metapolis is coming

But perhaps the most significant factor in recent price action is Metapolis, which launches as an early access event in Miami on April 2.

Commenting on Metapolis, Malkov said the Metaverse-as-a-service (MaaS) concept sets it apart from competing Metaverses. In that, users are free to create their digital world how they please – this has knock-on effects from a commercial point of view.

“Metapolis is a blank canvas; brands define their space to be whatever they want it to be. As a MaaS platform, Metapolis creates digital locations that fit each of its clients’ unique needs.”

Malkov also mentioned key highlights in the use of the latest gaming engines, Unreal Engine and Unity, for “visually engaging” experiences. As well as consideration of the safety with Know Your Customer (KYC) checks built into the protocol.

As ever, what happens with alt prices is determined to a large extent by the market leader, Bitcoin. But with plenty happening at Zilliqa, the fundamental strength to support price is there.

The post Zilliqa’s breakout: A look behind the numbers appeared first on CryptoSlate.